This third quarter market update highlights data and insights to provide you with a general overview of recent real estate activity in the Denver metro area.

Residential Market Update

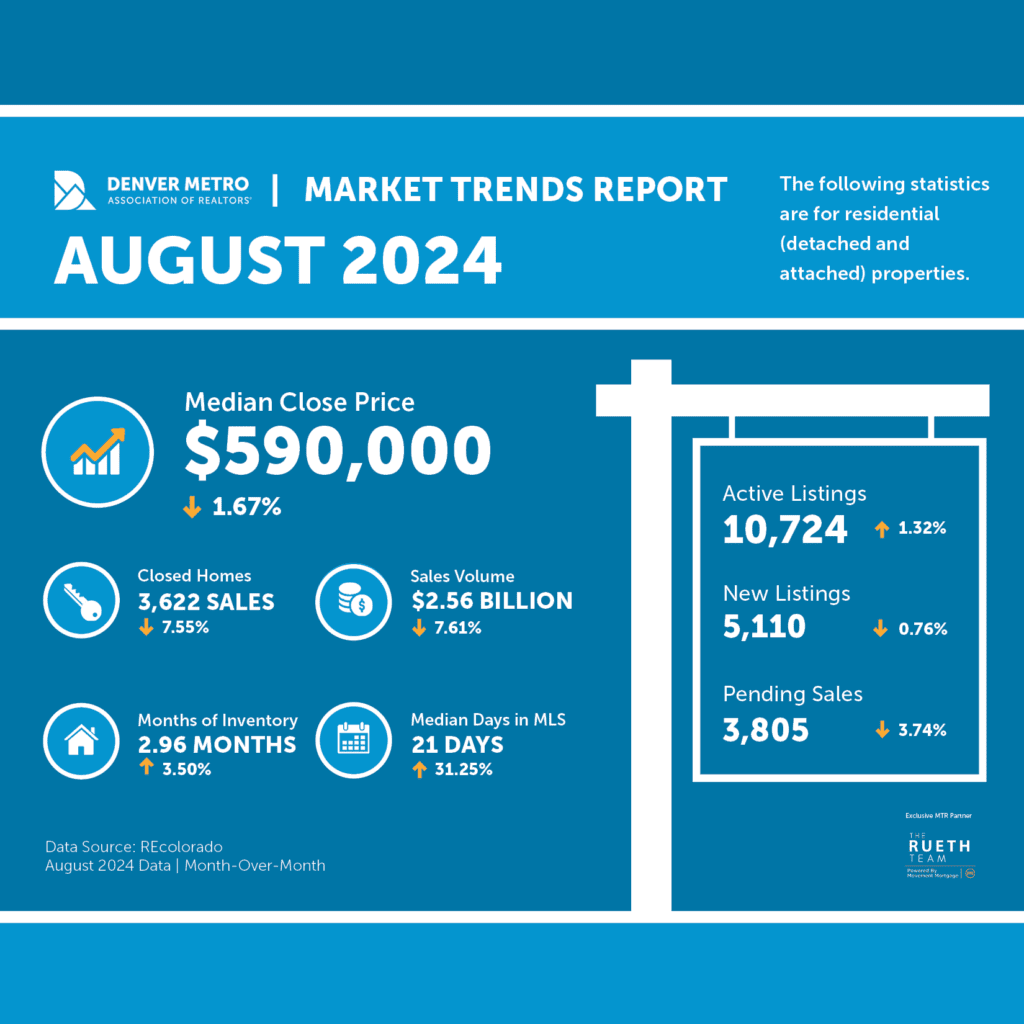

August data shows slight decline in new listings but increase in active listings, with seasonal trends and mortgage rates impacting buyer activity.

“Generally, there does not seem to be a large sense of urgency for buyers or sellers,” commented Libby Levinson-Katz, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “Buyers continue to watch the homes that have come up in their searches and may even be tempted to take a look. However, they aren’t placing offers on homes unless it perfectly aligns with their wish list. The DMAR Market Trends Committee has noted that transactions falling out of contract are on the rise. This may be due to buyers getting cold feet, the rise in contingent offers, lending issues or bullish sellers unwilling to negotiate inspection items.”

Market-wide, new listings fell slightly month-over-month by 0.76%, while active listings at month’s end climbed slightly to 10,724 homes, which is a 56.37% increase year-over-year. Pending sales increased 3.74% month-over-month and 7.7% year-over-year. Closed sales fell 7.55% month-over-month, which should go back up next month as closed sales are a lagging indicator due to a traditional 30-day closing. The median days in MLS continued to climb 31.25% to 21 days, a 90.91% increase year-over-year.

Attached Properties (Condos, Townhomes)

Active listings at month’s end remained nearly unchanged, with a 0.40% increase month-over-month to 3,227 homes, a 70.92% increase year-over-year. Median days in MLS also rose year-over-year at a sharp rate of 136.36% to sit at 26 days. The decline in median close price month-over-month is more telling, $396,350 from $415,000 last month and $418,000 from this time last year. This market segment has been largely affected by rising HOA dues, increased taxes, and insurance premiums.

Detached Properties (Single-Family)

A 50.85% increase in active listings at last month’s end with 7,497 homes. New listings fell by 1% while pending sales increased. The median close price remained stable at $650,500, down 0.69% from last month and up a mere 0.08% from last year. Median days in MLS climbed to 19 days.

Mortgage Rates

The Federal Reserve has just cut rates for the first time in over four years, reducing the benchmark rate by 50 basis points. This is a positive sign that inflation concerns are easing, which could help stimulate the economy. This will help relieve the high borrowing costs we’ve been experiencing, especially for mortgages, credit cards, and auto loans. With mortgage rates expected to decrease further and the highest inventory levels in over a decade, buyers now have more options than ever.

Rental Market Insight

August saw rents drop slightly for both the single- and multi-family rental markets. Median days on market decreased slightly in both markets.

- Single-family median rents were down three percent versus July. Median days on market decreased slightly to 24 days from 25 days in July and single-family listings increased by eight percent in August versus July.

- Multi-family median rents dropped one percent from July, and August rents are down just over one percent year-over-year. Median days on market dropped to 27 days, versus 29 days in July.

- Average concessions are 6-weeks free rent